Here are 9 Ways You Can Diversify Your Portfolio to Suit Your Investment Needs.

Your Money-Making Machine Isn't Working? Diversify Your Portfolio & Brew Up Financial Success! Click to unlock your financial potential!

Let's face it, nobody wants to be the Grinch when it comes to their financial future. Imagine opening your investment statement and seeing a big, fat lump of coal – depressing, right? The same goes for relying on a single investment.

Portfolio Management 101: It's Not Rocket Science (But It Can Be Rewarding!)

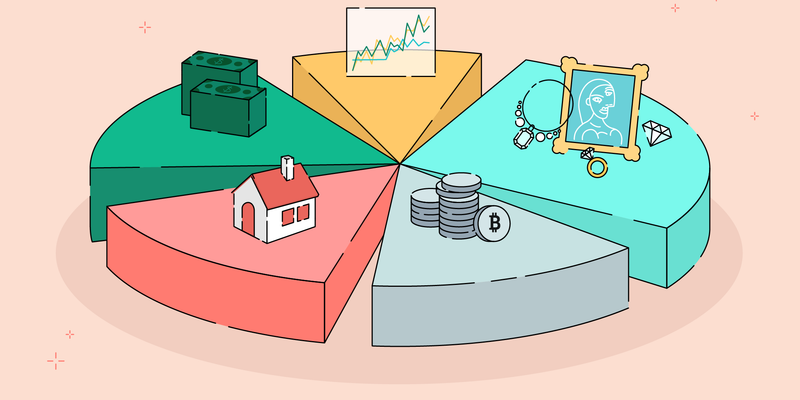

Think of your portfolio as a collection of all your investments – stocks, bonds, real estate assets, etc. Portfolio management is the art (and a little bit of science) of choosing the right mix of investments to achieve your financial goals while keeping risk in check. Diversification is the golden rule of portfolio management – it's like spreading your investment bets to minimise the impact of any single misstep.

Diversification Done Right: A Recipe for Success

Here are 9 ways to diversify your portfolio and become an investment maestro:

- Asset Class All-Stars: Don't stick to just one kind of investment. Spread your money around in stocks, bonds, and real estate to even out risk and up your chances for gains.

- Industry Icons and Hidden Gems: Dive into different areas within each type of investment. Put some money in big, well-known companies and also in new, promising ones for a full mix.

- Location, Location, Location (in Your Portfolio): Look beyond your borders! Putting money in foreign markets can open up new chances and protect against money value changes.

- Big Players and Small Caps: Big companies are stable, but small ones have room to grow. Having both can make your investment steadier.

- Value vs. Growth: A Balancing Act: Some stocks are steady earners while others are growing fast. Having a bit of both can keep things balanced.

- Bond Bonanza: Bonds are your safe bet, bringing in steady money. Make sure to have bonds of different lengths and reliability to keep things safe.

- Alternative Investments: Spice Up Your Portfolio (Literally!): Look into other ways to invest, like in buildings through REITs or in goods like crops or metals. But be careful, as these can be tricky.

- Rebalance Regularly: Like a car needs a check-up, so does your portfolio. Adjust your investments now and then to keep in line with how much risk you're okay with.

- Know Your Risk Tolerance: Know how much risk you can handle. Are you in for a wild ride or more for playing it safe? Knowing this helps pick the right mix for you. Don't be shy to ask for help if you need it.

The Takeaway: Diversification is Your Investment Superpower

By using these tips, you can make a mixed bag of investments that match your wants and how much risk you can handle. Keep in mind, that mixing up your investments isn't about dodging risk all the way; it's about spreading it to build a stronger and more rewarding path of investing. So, step up and diversify your investments like a champ – your future self will be thankful!

Edited by Rahul Bansal