VC investments in April declines by 12.6% due to lack of large deals

The decline in venture capital funding into Indian startups for the month of April 2024 reveals the continuous challenge of slower inflow of capital that the ecosystem continues to face.

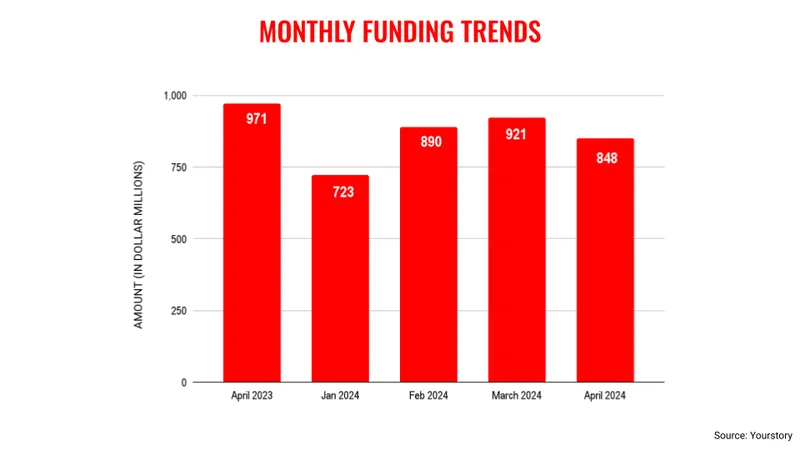

The month of April turned out to be a disappointing period for the Indian startup ecosystem as venture capital (VC) funding declined by 12.6% on a year-on-year (YoY) basis, and dipped 8% on a month-on-month (MoM) basis mainly due to the absence of large deals.

The total funding for the month of April 2024 came in at $848 million while the figure was $971 million for the same period a year ago. Similarly, when compared to the preceding month of March 2024, the funding amount stood at $921 million, as per data from YourStory Research.

This decline in VC funding shows the challenges the Indian startup ecosystem continues to face as the environment of “funding winter” continues to have its sway. This was disappointing considering there was a steady increase in VC funding in the first three months of 2024.

The slowdown in funding inflow into Indian startups is also revealed in the statistic of crossing billion dollars in funding on a monthly basis. The last time the Indian startup ecosystem received funding in excess of a billion dollars was in October, 2023. This billion dollar figure is an important psychological mark and adds up to the overall funding momentum.

The decline in VC funding for April month comes despite the number of deals touching 111, which was higher than March, which stood at 86. This reveals that the highest quantum of activity was in the early stage category, but the funding amount is always lower.

In fact, in the month of April, there was just a single deal which crossed the $50 million mark and that was from Parsons Nutritionals, which raised $80 million. Besides this, there was Northern Arc which raised $80 million, but this was a combination of both equity and debt.

The real boost to VC funding into Indian startups will only come in when there is higher activity in the late stage category, a segment which receives larger quantum of money. However, this segment is expected to pick up pace in another two quarters.

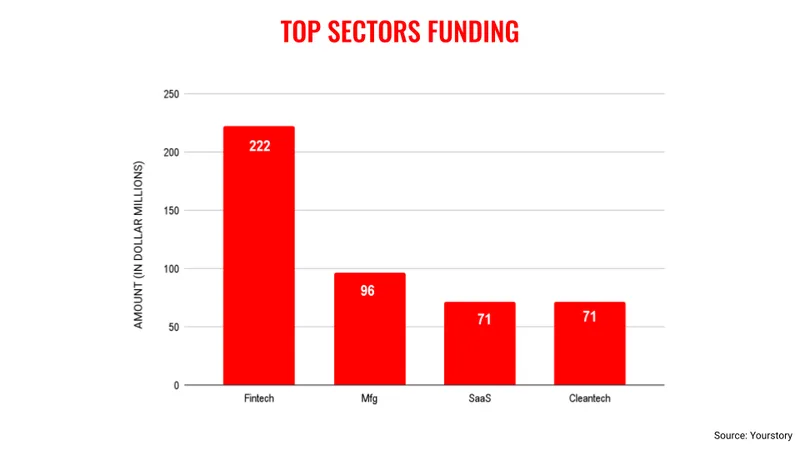

This trend was very noticeable in stage wise funding for the month. The growth category saw the highest amount at $357 million, while the late stage received just $30 million. In fact, the debt category witnessed an infusion of $222 million, which reveals the challenges that startups face in raising equity capital.

In terms of the segments which received the highest amount of funding, fintech received the highest amount at $222 million followed by manufacturing, SaaS, and cleantech. However, the heartening aspect is the increased investor activity in the cleantech segment.

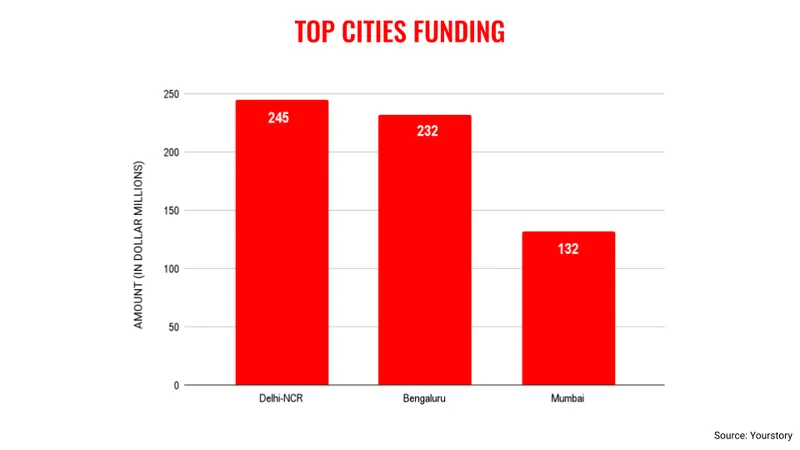

The month of April has shown a change in terms of cities that received the highest amount of VC funding. Delhi-NCR topped the list followed by Bengaluru and then Mumbai. Generally, Bengaluru has been on the top as it is considered to be the startup capital of the country.

Venture capital funding into Indian startups continues to remain challenging and industry observers believe that there are funds which are ready to deploy their capital, but waiting for the opportune time. The expectation is that it may happen during the last quarter of the year.

Edited by Megha Reddy